AbigBiz > Trade Study > ArticleTrade Study

African nations may be the new Brics

![]() ABigBizApr14, 2020【Trade Study】

℃

Leave a Reply

ABigBizApr14, 2020【Trade Study】

℃

Leave a Reply

The emerging market slowdown is affecting some countries worse than others, with comparatively resilient growth in African and the Middle East now attracting serious attention from the financial salesmen whose job it is to keep the investment dollars flowing.

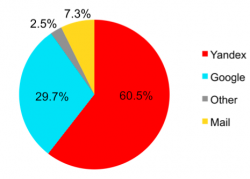

Brazil and Russia's growth has been especially sluggish since emerging markets boomed in 2004-2008, according to data supplied by London research consultancy Capital Economics.And while emerging Asia remains the fastest growing developing region, "growth has held up best in in the Middle East and Africa," Capital Economics economist Daniel Martin finds.That will be music to the ears of those bankers and consultants who are currently fishing out old China research notes from 2006, substituting the word "Africa" throughout.Africa is the next frontier for emerging market investors, according to some analysts, because the development of the middle class is expected to lift off.Many African nations also have young populations, as recent research from Moody's pointed out.This is a well-worn narrative that the financial industry applies to poor countries. But Multinationals are getting excited. Manufacturers such as Ford and Nissan are approaching this part of the world with a level of enthusiasm they once reserved for China.

The good sentiment is also translating into money flows. The Somali shilling has gained 30 per cent in the last six months. In the last three months, Egypt's EGX 30 has returned 9 per cent and the Nigerian Stock Exchange All Share Index is up 7 per cent.Of course, as with many emerging markets, there are those thorny issues of weak institutions, organised crime and corruption. But in developing world investment cycles, talk of such issues comes after the initial rush, once growth rates slow and cross-border deals turn sour. For now, the excitement seems to be warming up.

Brazil and Russia's growth has been especially sluggish since emerging markets boomed in 2004-2008, according to data supplied by London research consultancy Capital Economics.And while emerging Asia remains the fastest growing developing region, "growth has held up best in in the Middle East and Africa," Capital Economics economist Daniel Martin finds.That will be music to the ears of those bankers and consultants who are currently fishing out old China research notes from 2006, substituting the word "Africa" throughout.Africa is the next frontier for emerging market investors, according to some analysts, because the development of the middle class is expected to lift off.Many African nations also have young populations, as recent research from Moody's pointed out.This is a well-worn narrative that the financial industry applies to poor countries. But Multinationals are getting excited. Manufacturers such as Ford and Nissan are approaching this part of the world with a level of enthusiasm they once reserved for China.

The good sentiment is also translating into money flows. The Somali shilling has gained 30 per cent in the last six months. In the last three months, Egypt's EGX 30 has returned 9 per cent and the Nigerian Stock Exchange All Share Index is up 7 per cent.Of course, as with many emerging markets, there are those thorny issues of weak institutions, organised crime and corruption. But in developing world investment cycles, talk of such issues comes after the initial rush, once growth rates slow and cross-border deals turn sour. For now, the excitement seems to be warming up.

- END -

Finished browsing? You can ask me to comment and Leave a Reply!

Leave a Reply!

Other articles

- Tips for calling the foreigner

- The bright future of trading

- The Garbage B2B Websites

- Chinese data defy slowdown forecasts

- A Marathon Negotiation of Quotation

- Analysis of Australian Market

- Where Are My Customers?

- 6 reasons why every time B2B and B2C

- How to select the Keywords on the B2B Website

- Ebola Virus Reduces Import of Bauxite

Related news

B2B frequent random price adjustment, Whether caused by the effect of business or negative

In the current economic environment, the worlds leading B2B website is very norma...5 Online B2B Marketplaces That Can Help You Grow Your Business

Many small to medium sized B2B companies are finding their local business stagnan...Key points of being a successful salesman

People always said that, there always be ways of success and ways of failure. Whe...The former empire strikes back

Is it a great opportunity for mutual benefit or a case of the empire striking bac...

Leave a Reply

- 全部评论(0)

说点什么吧

还没有评论,快来抢沙发吧!

Popular this month

The best communication time

The best communication timeRecommended

As for the foreign trader, we usually need to negotiate and communicate with the ...

Russian market has been a big chance for foreign trade salesmen because in recent...

Hello everyone! Today I would like to introduce some useful and daily apps in Ind...

As we all know, the hot products play an important part in the development of a s...

Tags

You love

- 10 Sentences That Will Make You Smile

- How to Maintain Your Old Customers?

- Tips for Final Fighting in 2016

- How to Write Claim Letters

- I Was Just the Tool

- What Are You Going to Ask

- Analysis Helps You Win Order!

- What's Wrong With Your Quotation?

- African nations may be the new Brics

- Unfathomable Foreign Trade

微信扫码打赏

微信扫码打赏 支付宝收款码

支付宝收款码